What Does 30 LPA Mean Per Month After Tax?

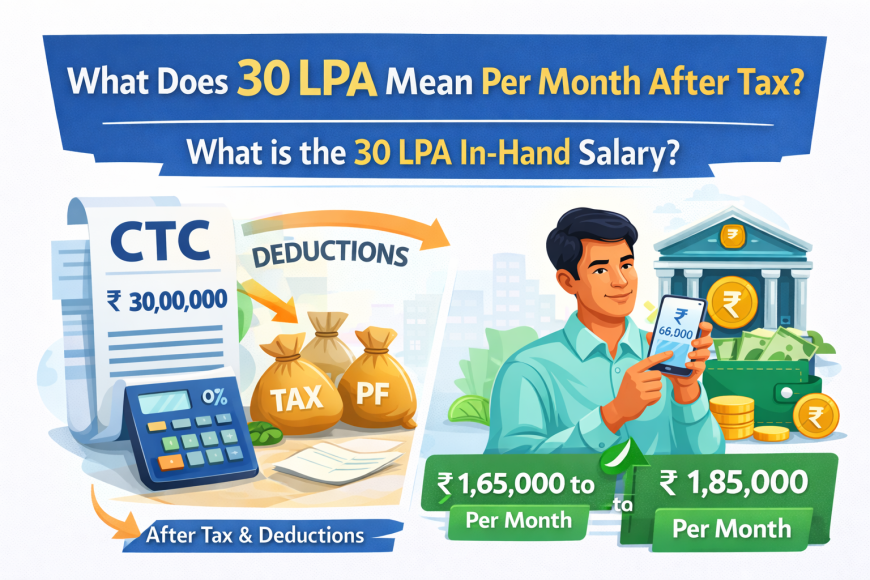

What does 30 LPA mean per month after tax? Understand the real 30 LPA in hand salary, monthly take-home, taxes, PF, and deductions in simple terms.

A 30 LPA salary sounds impressive on paper, but the real question most professionals ask is: “How much of it actually comes into my bank account every month?”

If you’re earning—or planning to earn—₹30 lakhs per annum, understanding your 30 LPA in hand salary after tax and deductions is crucial for financial planning, lifestyle decisions, and long-term savings.

Let’s break it down step by step and uncover the real monthly take-home reality of a 30 LPA package in India.

Understanding 30 LPA: CTC vs In-Hand Salary

First, it’s important to know that 30 LPA usually refers to CTC (Cost to Company), not your take-home pay.

CTC Includes:

-

Basic salary

-

House Rent Allowance (HRA)

-

Special allowances

-

Employer PF contribution

-

Bonuses & variable pay

-

Gratuity (sometimes)

-

Insurance & other benefits

👉 Your in-hand salary is what remains after deductions, not the full 30 lakhs.

Gross Monthly Salary on a 30 LPA Package

Let’s do a simple calculation:

-

Annual CTC: ₹30,00,000

-

Monthly CTC: ₹2,50,000

However, your gross monthly salary (before tax) is usually lower than monthly CTC because components like gratuity and employer PF are not paid monthly.

Typical gross monthly salary:

-

₹2,10,000 – ₹2,30,000

Common Deductions from a 30 LPA Salary

Several deductions reduce your final take-home amount.

1. Income Tax

At 30 LPA, you fall into the highest tax slab (30%) under the old tax regime.

2. Employee Provident Fund (PF)

-

12% of basic salary

-

Usually ₹7,000 – ₹9,000 per month

3. Professional Tax

-

₹200 per month (varies by state)

4. Other Deductions

-

Health insurance

-

Meal cards / benefits

-

Company-specific deductions

Income Tax on 30 LPA Salary (Old Regime)

Here’s an approximate annual tax calculation (after standard deduction):

-

Gross Income: ₹30,00,000

-

Standard Deduction: ₹50,000

-

Taxable Income: ₹29,50,000

Income Tax Breakdown:

-

0–2.5L → Nil

-

2.5–5L → 5%

-

5–10L → 20%

-

Above 10L → 30%

Total Income Tax:

➡️ ₹7.5L – ₹8.5L (including cess)

30 LPA In Hand Salary Per Month (After Tax)

After accounting for tax, PF, and other deductions:

👉 Monthly In-Hand Salary:

-

₹1,65,000 to ₹1,85,000 per month

👉 Annual In-Hand Salary:

-

₹19.5L – ₹22L per year

This range varies depending on:

-

Tax regime chosen

-

HRA claims

-

Bonuses & variable pay

-

Investment declarations

Old Tax Regime vs New Tax Regime

Old Tax Regime

✔ Allows deductions like:

-

HRA

-

Section 80C (PF, ELSS, LIC)

-

80D (Health insurance)

✔ Often better for salaried employees at 30 LPA

New Tax Regime

✔ Lower tax rates

❌ No major deductions

👉 For most people, old tax regime gives a higher 30 LPA in hand salary if they plan investments well.

Bonus & Variable Pay Impact

Many 30 LPA packages include:

-

Performance bonuses

-

Annual incentives

⚠️ These are:

-

Paid yearly or quarterly

-

Fully taxable

-

Not part of fixed monthly salary

So your monthly in-hand salary may look lower, but annual income increases when bonuses are paid.

Is 30 LPA a Good Salary in India?

Absolutely—30 LPA is considered a high income in India, especially for professionals in:

-

IT & Tech

-

Product management

-

Consulting

-

Finance

-

Senior marketing roles

But lifestyle inflation, taxes, EMIs, and city costs (Bangalore, Mumbai, Gurgaon) can still eat into savings if not planned wisely.

How to Increase Your 30 LPA In Hand Salary

Here are smart ways to maximize take-home pay:

✔ Claim HRA Properly

If you live in a rented house, HRA can save lakhs in tax.

✔ Use Section 80C Fully

Invest ₹1.5L in:

-

EPF

-

ELSS

-

PPF

✔ Health Insurance (80D)

Extra deductions up to ₹25,000–₹50,000.

✔ Choose the Right Tax Regime

Compare old vs new regime every year.

Final Thoughts

So, what does 30 LPA mean per month after tax?

👉 A 30 LPA in hand salary typically translates to ₹1.65–1.85 lakh per month, depending on taxes, deductions, and benefits.

While the headline number looks big, smart tax planning and expense management are what truly decide how comfortable your lifestyle and savings will be.