US Ambulatory Surgical Center Market Role of Orthopedic and Spine Centers

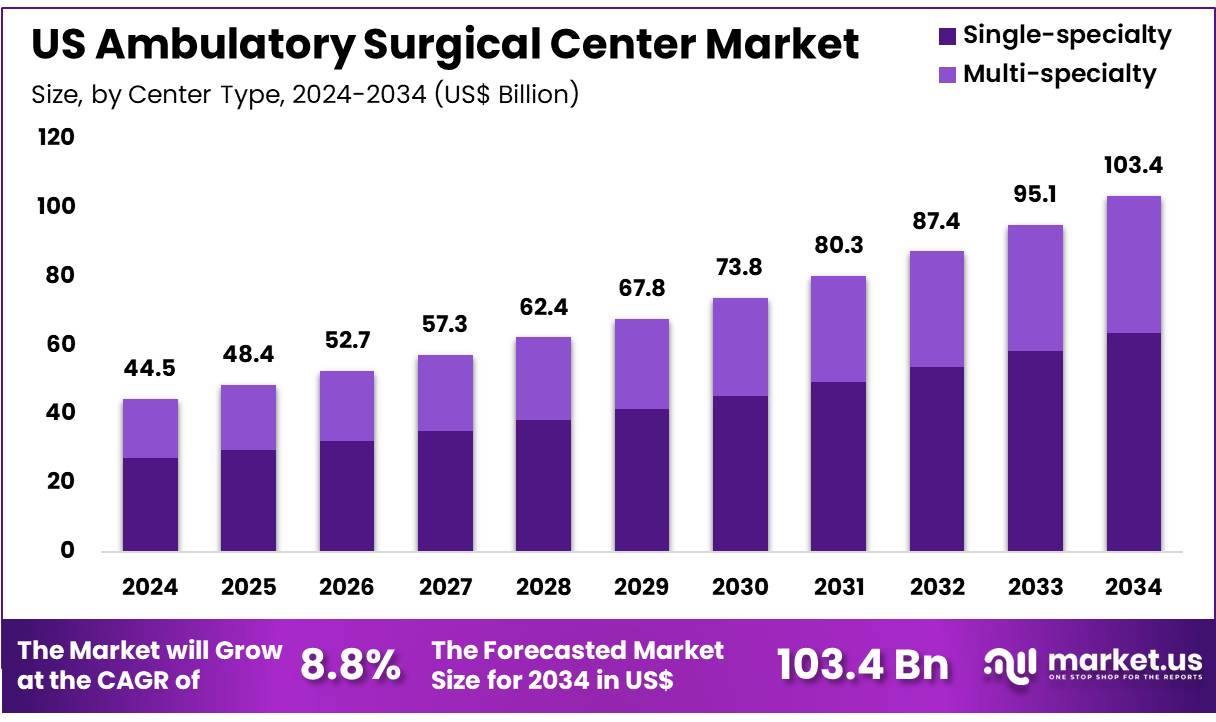

The US Ambulatory Surgical Center Market size is expected to be worth around US$ 103.4 Billion by 2034 from US$ 44.5 Billion in 2024, growing at a CAGR of 8.8% during the forecast period 2025 to 2034.

The US Ambulatory Surgical Center Market size is expected to be worth around US$ 103.4 Billion by 2034 from US$ 44.5 Billion in 2024, growing at a CAGR of 8.8% during the forecast period 2025 to 2034.

In 2025, the U.S. Ambulatory Surgical Center Market continues its ascent as patients and payers favor on-site, efficient outpatient procedures over hospital admissions. Advances in minimally invasive techniques allow complex procedures—such as spinal injections, joint arthroscopy, and cataract removal—to be safely performed in ASCs with same-day discharge. Health systems are signing value-based contracts with ASCs to reduce costs and avoid hospital readmissions.

Rapid pre-op assessments, standardized pathways, and patient-centric recovery spaces enhance satisfaction. As consumer preference for convenience grows, and health plans seek cost-effective care, ASCs are firmly positioned as frontline surgical hubs, delivering specialized services at lower cost and higher turn-around compared to inpatient settings.

Click here for more information: https://market.us/report/us-ambulatory-surgical-center-market/

Key Market Segments

Center Type

- Single-specialty

- Multi-specialty

Ownership

- Physician Owned

- Hospital Owned

- Corporate Owned

Speciality

- Orthopedics

- Pain Management/Spinal Injections

- Gastroenterology

- Ophthalmology

- Others

Emerging Trends

- Expansion of ASCs offering advanced pain-management procedures and spinal injections outpatient.

- Value-based care agreements linking ASC reimbursement to readmission and complication rates.

- Dedicated ASCs for ophthalmology and orthopedic procedures with standardized pathways.

- Deepening patient engagement through online scheduling, pre-op education, and recovery guidance.

Use Cases

- A pain-management ASC performs cervical epidural steroid injections with same-day discharge in under 3 hours.

- An orthopedic ASC enters a bundled payment contract with insurers for ACL reconstruction, sharing savings.

- A cataract ASC reduces cycle time by 25% by automating pre-op checks and streamlined patient flows.

- Patients access virtual pre-op orientation modules and receive post-op texts to guide recovery at home.

Kanesmith11

Kanesmith11